Energy & Earth Resources

The XS Exchange (XSE) is a digital facilitated marketplace where companies can exchange any XS B2B and turn their waste into additional revenues. The XSE is like a dating site for materials which matches both the supply with the demand, and the demand with the supply, by matching materials with their highest value reuse or recycle opportunity.

Material buyers will use XSE as a reliable supply of XS - which saves them money over purchasing virgin material, while material sellers will find new customers for their secondary materials, saving waste processing fees and turning them directly into additional revenues.

At its core, XSE is a blockchain-enabled application which uses the power of smart contracts to create the necessary transparency, traceability and reliability required in the recycling market. The products and materials are registered and tracked with a unique ID and a list of materials they contain, where the highest value recycle and reuse opportunities are automatically computed at search time by applying a sequence of known recycling processes. The tracing of the ownership and location of the materials is achieved via unfungible material tokens, which can be freely traded on the marketplace or on secondary markets.

The XSE smart contracts handle all operations of exchange, escrow and insurance, but more importantly, they are used to create potential recycling pathways and propose them to the users. Artificial Intelligence will aid in finding the optimal matches according to the search criterias, and to analyze digital literature to find novel recycling processes which would further optimize the exchanges.

We envision the XSE to play a key role into enabling a smooth and rapid transition towards a circular economy, with major economic, social and environmental benefits.

Technology

The functionalities of XSE described in this document are implemented as an interface to an ecosystem of smart contracts. A smart contract is a computer protocol intended to digitally facilitate, verify, or enforce the negotiation or performance of a contract. Smart contracts allow the performance of credible transactions without third parties. The Ethereum blockchain is currently the most mature platform available for the implementation of smart contracts, and therefore chosen as the platform on which to base XSE.

From the ethereum website:

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third party interference.

These apps run on a custom built blockchain, an enormously powerful shared global infrastructure that can move value around and represent the ownership of property. This enables developers to create markets, store registries of debts or promises, move funds in accordance with instructions given long in the past (like a will or a futures contract) and many other things that have not been invented yet, all without a middleman or counterparty risk.

The XSE Token System

The Excess Material Exchange digitally represents every excess material into the form of material tokens . These could be directly minted by the platform (by registering a material or a product), or mined from registered products (material bundles).

Material Tokens

Every raw material introduced into the exchange has its own token class, defined by its ID and resource definition. Declaring the existence of a material into the platform automatically mints tokens. These tokens are not not fungible: once materials enter the platform, they will always be traceable.

The token also contain additional information associated with each material, starting from the quantity and the location, and extendable to contain more specific characteristics such as purity, shape, location, age, last owner etc..

The material tokens can be freely traded within the marketplace, and purchased on secondary markets. By purchasing a token, the buyer is effectively signing a digital contract to own the actual materials that they represent. The transaction is completed at the moment that the physical material is received. At this stage, this also act as the validation of the existence of that material and its history so far. Information regarding the location and ownership of the resources are perpetually written on the ledger. We can use this information track and trace the materials, effectively creating the beginning of a “value web”. This will highlight how the material flow and localise their position for current business and future generations.

Material Bundles

In order to be able to transition to a circular economy, it is necessary to trace materials even if they are bundled together with others into products.

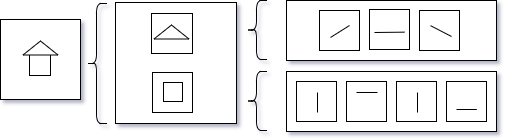

Therefore, in XSE, every product or material is represented as a resource passport, a sort of “material bundle”, where the product is specified as the sum of its components, and its components specified as its respective basic material content. This recursive structure allows all materials and products to be traced at different levels, preserving all the fundamental information necessary to find best value reuse or recycling opportunities. A product manufacturer or recycler can create a product definition, by specifying the product ID and the list of its contents. In the illustrated example, the material passport specifies that a wooden house consists of two parts: a roof and a base, and each of these consists of a special arrangement of sticks with different lengths and properties.

Material Processing

Declaring all the materials and components within a product does not directly mean that all the materials would directly be available for reuse or recycling.

Material processing contracts are introduced to digitally represent the knowledge of transformation processes available through the platform.

Each processing contract needs to specify the ID of the token of the materials (or bundles) it takes as input (Material Inlet) and the ID of the materials tokens which can be given as output (Material Outlet), together with its quantities.

In the illustrated example, Recycler 1 declares a process to separate the wooden house in two parts: a base and a roof. Additional parameters, such as additional costs, CO2 emissions, water usage, and geolocation also need to be specified at this stage. These will aid the platform to select a recycler instead of another with the same characteristics, but different location, cost, emission etc..

The recycles who optimize the material processing from specific bundles are automatically preferred by the platform as the most efficient recycling pathway, since they are able to extract more value from the original product. The recyclers are incentivized to declare their best recycling rate estimate to be selected as recycling facility, yet to be conservative as they can always reintroduce XS as new material sources.

Suppliers (Material Providers):

Material Providers input materials or material bundles into the platform. It can also represented as material process without an inlet.

They bring their XS to the platform by uploading or selecting a resource passport os outlet. Additional parameters are location, quantity, and expiration day of the availability. If the material is contained within a product, they are also responsible to declare the correct material bundle. To avoid abuse, this process is moderated by a small fee per entry.

Buyers (Material Consumers):

Material Consumers submit searches to purchase materials out of the platform by adding a request for specific materials they need. They also specify location and quantity, expiration date and how much they are willing to pay. This information remains private. They can also subscribe to material channels, where they get notified of the new availability of materials in their interest. This process is free of charge up to the point of a match.

Direct Exchanges

Direct exchanges is the basic function of any exchange.

The supply is directly matched with the demand, so that an entity could source material if another entity is willing to provide it as is.

This is the same process which occur in the traditional marketplace. Match the match is often aided on the base on different characteristics (eg: size, state, location, age, location, ...)

In the illustrated example, only one (partial) match is possible.

Indirect Exchange

The XSE adds an additional layer of functionality to the traditional exchanges. In fact, when looking for a match, the marketplace doesn’t only search between the direct matches, but also uses the known processes to generate pseudo demand and pseudo supply.

The platform enumerates all possible combinations, find the most viable ones depending on the search criteria, and then present the highest value opportunities.

Pseudo Supply

The pseudo supply are the materials that would be available to the platform if all material processing contracts were activated using the supply currently available to the platform. A direct acyclic graph is created and traversed to enumerate the available pseudo supply.

From the buyer’s perspective, the pseudo supply is equivalent to the normal supply, but the costs involved to turn the available supply into the pseudo one is accounted for in the final price.

Pseudo supply is most likely more expensive than a normal direct exchange, but it creates the possibility of sourcing different materials from the platform which would not have been available otherwise. The pseudo supply gives secondary material multiple reuse/recycle opportunity, which can be picked up on the demand side.

Pseudo Demand

On the other side of the pseudo supply, there is the pseudo demand.

This is the demand created from travelling back the potential recycling outlets into their inlet, starting from the declared demand. It represents a selling opportunity for companies that have the material available but have not listed it into the platform. A material in high pseudo demand would quickly be recycled, thus representing a significant opportunity for gains.

Material Pathways

The material processes can also be applied for multiple times (eg: processing the processed material), the marketplace will showcase both real and pseudo materials pathways.

The XSE will enumerate the possible recycling pathways, both using real and pseudo resources, and present the found opportunity in an easy-to-read interface. The interface allows a clear overview of the tradeoff choosing a pseudo pathway with respect to another.

While enumerating the pseudo-supply and the pseudo demand, the marketplace automatically adds the parameters required for the material processing pathway, including CO2 emission, water usage, and distance. The results are presented the buyers will have a direct overview of how much material can be sourced from the platform, and what would be the costs and timeline associated with the exchange.

In general, we do expect the pseudo pathways to be more expensive than the direct exchange. However, as the materials are secondary and might also be entirely sourced from the platform, we expect the total cost to still be significantly lower than directly sourcing the virgin material. In fact, applying the virtual processes will significantly enhance what could be sourced from the marketplace. In the illustrated example, starting from the same demand and supply as in the in the direct exchange example, the XSE is able to match all materials, while only introducing one excess material supply for recycler 3.

Payments

When a match is found, the buyer initiates the exchange by depositing the money for the purchase of the material and the processes involved. This means that everyone in the process already has received the money, as long as the complete the task. All this process is handled by a smart contract, which traces the material pathway all the way to the supplier. All parties involved in the transaction will have visibility of its status and of the processors involved.

Initial Deposit (Insurance)

An initial deposit is required to subscribe a material process on the platform. The deposit acts as an form of insurance of the reliability of the processor, and incentivize the processor to behave accordingly to what he declared. The deposit can be returned by simply deleting the respective material process from the platform.

As an incentive to maximise the insurance of the contract, the contract will not accept deals bigger than their deposit. This is because, in case of default, the deposit will be used as payment for the processes which could not be completed because of the defaulting party. As a bigger deposit might bring bigger deals, the recycler is incentivized to set the deposit to his actual capacity.

Escrow payment

When a pathway between a material supplier, processes and a material buyer is found, the buyer can initiate a trade request by submitting a downpayment to the escrow smart contract. The escrow payment would generally be equal to the total of the deal, although we do not exclude situations in which only a percentage of the deal goes in the escrow agreement. Whenever the buyer receives the material and submits the confirmation, the escrow (and eventually the full payment) is released and the monetary and material token transfer is submitted to all participants in the selected processing pathway. Once finalized, and the material tokens validated.

Dispute

In the case of a dispute such as the lack of delivery or quality by one of the parties involved into a deal, the platform is notified and a dispute resolution process is opened directly involving the interested parties. An independent moderator will get in touch with the parties, consider the issue and decide to 1) Refund the escrow to the buyer 2) Complete the trade and allow the payment to the reach supplier 3) arbitrarily split the escrow. Failure to complete a transaction will compensate non-defaulting parties using the deposit. Material processors will not be able to accept new deals or be deleted while handling a dispute.

In case the escrow is refund to the buyer, the unsold materials are automatically reintroduced within the platform. It is up to the provider to modify the parameters which did not allow the trade to complete.

Exchange fee

A small transaction fee for any completed trade remains within the platform, in a multi-signature wallet controlled by the core team and accessible through a proposal system. The transaction fee will be tunable by the core team (between 0% and 10%), so that the platform will have ways incentivise trades on specific dates (eg: a “circular month”).

Using a publicly accessible chain with a fee embedded directly into the smart contract allows anyone to perform trades even outside of the excess material exchange interface. Third parties will have ways to directly interact with the marketplace at the smart contract level. This will be extremely useful to integrate the information with existing resource management software. The martketplace fees will always paid as part of the smart contracting system.

Material Flows

All available processes and completed transactions will be used to populate what we call the material flow. This information will allow users of the XSE to have an overview on how the materials flow within the platform.

This information is also highly valuable to understand how the platform is being used, and will give more insight which could be used for better matchmaking.

Furthermore, by matching the real supply and demand with the pseudo supply and demand, gaps will emerges. XSE will monitor these situations and suggest potential recycling opportunities by looking at scientific literatures. These suggestions will be investigated by XSE and the right parties will be contacted fulfill that role.

Last updated

Was this helpful?